User Experience

Wednesday, 15 May, 2024

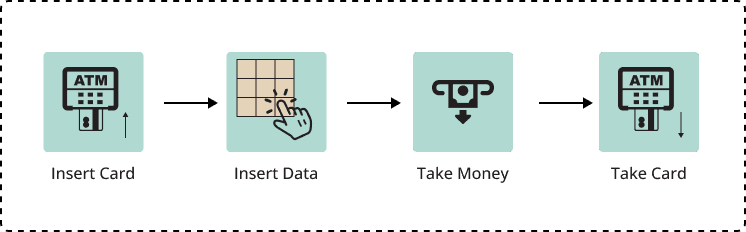

Have you ever observed people hitting the 'clear and cancel' button multiple times after withdrawing money from an ATM? This behavior quite common, and the reason behind it might surprise you.

Recently, while waiting in an ATM queue, I observed people withdrawing money and then hitting the 'clear and cancel' button repeatedly. When I asked why they were doing this, one lady explained that it was to ensure that the transaction was complete and no information was stored in the system for any fraudulent activity. This made me question the experience of withdrawing money from the ATM.

#Psychology

Humans tend to experience a greater emotional impact from losing something they have than from gaining something new. This means that losing $1,000 may cause more distress than the pleasure of gaining the same amount.

Upon further observation, I found that many people are unsure whether their transaction has been completed or not, despite receiving a message on the screen. This uncertainty can cause anxiety and lead to fear of fraud, prompting users to hit the 'clear and cancel' button repeatedly. It's not just limited to a particular age group, area, or literacy rate; most people do it subconsciously.

The feedback provided during a transaction is not clear or accurate, which can cause confusion and frustration. Many people are risk-averse and want to avoid making mistakes. When they are uncertain whether a task has been completed or not, they may worry that the task could lead to an error or a negative outcome.

However, there are ways to improve the user experience at ATMs. Here are some potential methods:

Utilising color coding

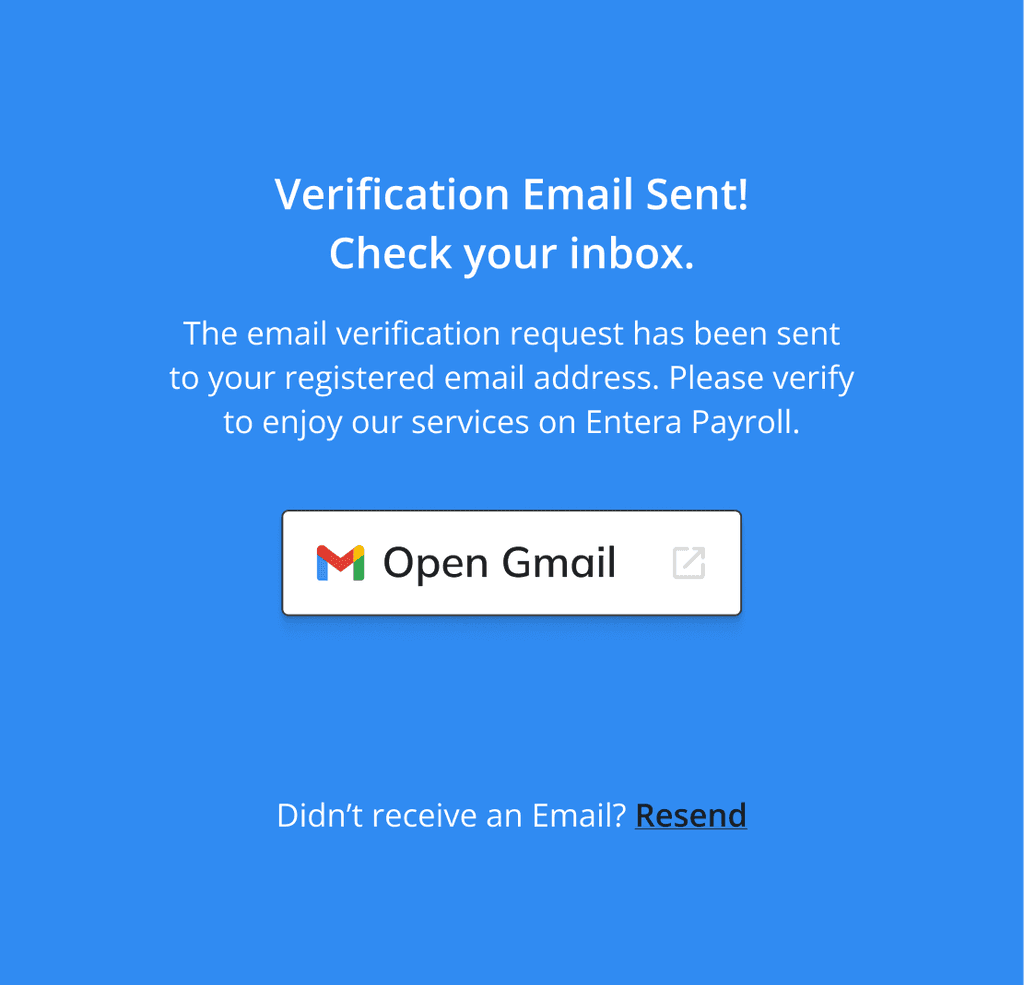

Incorporating a color scheme that effectively signifies the successful completion of a task, such as a green color scheme for task completion, can reduce uncertainty and anxiety among users. This visual cue can help users to be more confident that their transaction has been completed successfully.

Modifying the layout of the task completion screen

Changing the layout of the task completion screen can help to reduce user uncertainty. By making the task completion screen more prominent and including a clear message indicating that the transaction was complete, users would be less likely to hit the 'clear and cancel' button repeatedly.

Providing clear instructions after transaction completion

Displaying a screen after the transaction is complete, clearly specifying the button to be clicked in order to finalise the procedure, can help users to understand what they need to do next. This could reduce the anxiety that many users feel when they are uncertain about whether their transaction has been completed.

In conclusion, the use of the 'clear and cancel' button at ATMs is a common behavior driven by uncertainty and risk aversion. ATM users want to avoid negative outcomes and potential security risks, leading them to repeatedly hit the button as a precautionary measure. To improve the user experience, banks and ATM manufacturers could consider implementing clearer and more accurate feedback during transactions, such as color coding and more explicit confirmation screens. Understanding the psychology behind this behavior can help financial institutions design better interfaces that reduce uncertainty and improve the overall user experience.

Keywords: ATM Experience, Psychology